Higher rate tax relief is given by increasing the basic rate and higher rate band by the amount of gross contribution paid into a personal pension. The effect of this is that the investor will get higher rate relief by paying basic rate tax on income that they would have otherwise paid higher rate tax on.

Tax relief limits

The maximum amount of contributions on which a member can claim relief (up to their available annual allowance) in any tax year is the greater of:

- the ‘basic amount’ – currently £3,600, and

- the amount of the individual’s relevant UK earnings that are chargeable to income tax for the tax year.

Claiming the tax relief

Personal pensions that are run on a 'relief at source' basis (including the Quilter personal pension and Collective Retirement Account) will give basic rate relief within the pension scheme. If an investor pays £80 net, the scheme administrator will invest £100 into the personal pension and claim the £20 tax relief back from HMRC on behalf of the investor.

A higher rate taxpayer will be entitled to another £20 of higher rate relief (or £25 if they pay tax at 45%). This is claimed by the investor through their Self-Assessment or by sending a letter separately to their tax office.

Tax relief is not available for employer contributions which are paid gross. The employer may be able to offset the pension contribution as a business expense against their corporation tax bill.

Calculating the tax relief

Higher rate tax relief works by increasing the thresholds upon which an investor pays basic and higher rate tax by the amount of gross personal pension contribution paid. This is detailed in Income Tax Act 2007 part 2 chapter 3 and FA 2004 section 192 (4).

Example 1

Take an individual earning £61,450 who would normally be paying 20% tax on £37,700 of income, after personal allowance, and 40% on the next £11,180: the individual paid a £11,180 gross personal pension contribution this would push the basic rate band up to £48,880 (after personal allowance), meaning that the individual now pays tax at 20% on all income and no longer pays any higher rate tax. The individual receives higher rate tax relief, by not paying higher rate tax.

So here the individual received 20% relief through self-assessment and the other 20% relief is received at source through the pension provider by paying a net contribution and seeing it grossed up within the scheme, giving them a total of 40% on the full £11,180 gross contribution.

Example 2

Example 3

Both basic and higher rate thresholds increase by £10K. This effectively replaces some of the higher rate with the equivalent increase in the basic rate. They therefore receive 25% relief. Adding that to the 20% gross up by the provider gives 45%.

| Calculation for example 2 | ||

| Employment Income | £170,000 | |

| Less Personal Allowance | £0* | |

| Taxable Income | £170,000 | |

| Tax payable | ||

| Income tax at 20% on first £37,700 | £7,540 | |

| Income tax at 40% on next £87,440 | £34,976 | |

| Income tax at 45% on next £44,860 | £20,187 | |

| Total income tax payable | £62,703 |

| Calculation for example 3 | |

| Employment Income | £170,000 |

| Less Personal Allowance | £0* |

| Taxable Income | £170,000 |

| Tax payable | |

| £10,000 pension contribution increases basic rate and higher rate band by £10,000 | |

| Income tax at 20% on first £47,700 | £9,540 |

| Income tax at 40% on next £87,440 | £34,976 |

| Income tax at 45% on next £34,860 | £15,867 |

| Total income tax payable | £60,203 |

*In this example client has no personal allowance left as the allowance is reduced by £1 for every £2 of income over £100,000.

The client has received the full 45% tax relief on a £10,000 gross personal contribution to a personal pension.

Tax relief given is a combination of paying £2,500 less tax on their income, together with the £2,000 of tax relief granted within the pension scheme, giving them total tax relief of £4,500 on a £10,000 contribution.

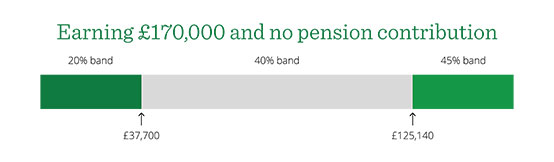

Income tax bands for 2024/25 (ignoring dividends)

Personal allowance is £12,570

Basic rate of 20% tax on income up to £37,700

Higher rate of 40% on income between £37,700 and £125,140

Additional rate of 45% on income over £125,140

Scotland

Since tax year 2016/17 the Scottish Parliament can set their own income tax rates and bands. It has been confirmed that in all cases Scottish taxpayers will still receive basic rate tax relief of 20% on all pension contributions paid personally. The members will be able to claim back any tax they have paid over 20% via self-assessment for all additional tax bands.

Alternatives to relief at source method

There is an alternative way to receive tax relief on pension contributions known as the 'net pay arrangement'. This is only applicable where personal contributions are deducted through payroll by the employer. As the contribution is taken from the member’s pay before tax is calculated they have effectively been given full tax relief. It is not possible for a personal pension scheme to be run on this basis.

Occupational schemes will operate on the 'net pay' basis.