We are often asked whether a bond or a collective is the right choice for a particular client. This isn’t a new dilemma however, with the reductions to the Capital Gains Tax (CGT) Annual Exempt Amount and Dividend Allowance followed by increases in CGT rates, the decision is in the spotlight.

Before looking at the products it is important to consider the client objective(s). Tax planning will often be a key consideration but there may be occasions when the position is less important. For example, bonds are often the primary choice for inheritance tax planning. Bonds are considered non-income producing and they help trustees limit the reporting they are required to do. Bonds also offer flexibility by the ease of assigning all or part of them. The trust solutions offered by insurers are also generally packaged around a bond so there is no decision about the product if the IHT solution meets the client objective.

If the objective can be achieved equally well by a number of products then tax might be a differentiator and therefore, the considerations are:

- CGT rate vs. Income tax rates

- Personal savings and dividend allowances

- CGT Annual Exempt Amount

At first glance these factors may favour the unwrapped or collective (general) investment account. However, other products might offer other benefits which are more important to the individual than tax. We provide a Net Returns Calculator to help you understand the impact tax can have on investment returns across 3 different product ‘wrappers’. These returns, along with specific client objectives can help you make an informed decision when making this ‘wrapper’ decision for your clients. The tool can be accessed here: Net Investment Returns Calculator | Quilter

Examples

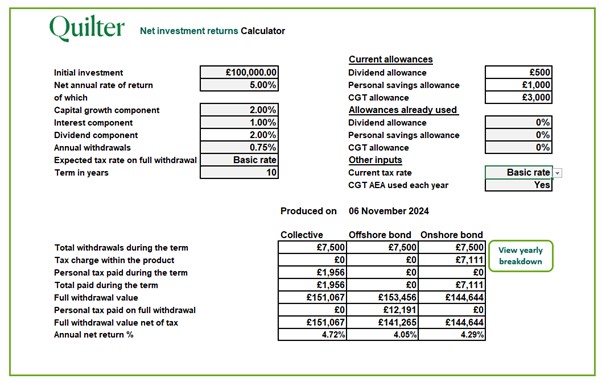

Below are some examples of projected returns on 3 ‘wrappers’ over a 10 year period. These projections do not include product charges but purely look to review the taxation on the respective products. A 0.75% withdrawal has been entered to illustrate a potential ongoing advice fee. To provide a net return position, tax suffered during the term has been deducted from the products.

Basic rate tax payer:

As you would expect, the offshore bond provides the best gross return. The absence of life fund taxation and generally tax-free income (with the exception of some withholding tax) helps to return £53,456 after 10 years (a 53.46% increase). The collective, comes second in the gross return (51.07%). It suffers just a small amount of tax on interest and dividend distributions exceeding the respective allowances. Finally the onshore bond comes third (44.64%), the life fund taxation amounts to £7,111 over the 10 years.

This then gets turned on its head when you look at the net return on surrender. The collective jumps to first place, with the CGT annual exemption covering the remaining gain, leaving no tax to pay. In second place is the onshore bond with no further tax payable for a basic rate taxpayer (assuming top slicing relief keeps the gain under the higher rate threshold). Then in third place, the net return of the offshore bond, which has now had a 20% tax deduction on the gain.

There are some planning points here though as the surrender of the products in one go is rarely the best way to go:

- Part of the collective could have been transferred to a spouse to make use of two sets of tax allowances, reducing tax paid on income

- The collective has assumed regular management of gains annually, avoiding one big gain on surrender

- The offshore bond could be assigned to a non-tax paying spouse to utilise Personal Allowance, Savings rate of tax and Personal Savings allowance

- The investments may have been established with the intention of moving some or all of the investment into an appropriate trust solution at a later date. The question of tax on surrender by the original owner then doesn’t arise. Instead, it becomes a longer-term generation planning exercise with the potential to use funds in the future on behalf of the next generation

This list is not exhaustive but gives an idea of some of the action that could be taken to reduce the impact of tax when an investment comes to an end.

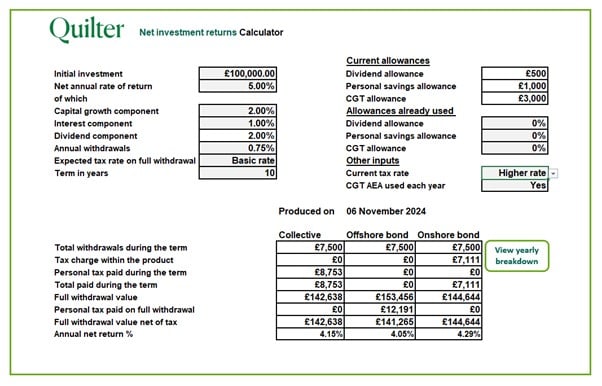

If we compare this to a higher rate tax payer during the term but a basic rate on surrender (either by reduced earnings or assignment to spouse) the first placed product changes again:

No change in the gross return winner, the offshore bond. However, much more tax has been paid on the collective during the term with 40% payable on the interest earned over £500 Personal Savings Allowance and 33.75% on dividends above the Dividend Allowance. The onshore bond doesn’t change as it is not influenced by the tax rate of the investor until a chargeable event occurs.

On surrender, a basic rate taxpayer pays 18% on the collective if any gain exceeds the Annual Exempt Amount, no further tax on the onshore bond and 20% on the offshore. The net winner this time is the onshore bond. This is because the yields during the term have been sheltered from higher rates of tax and the credit covers the basic rate liability on surrender. The offshore bond does similar in shielding from higher rates during the term but the 20% paid on surrender is higher than that suffered within the onshore ‘wrapper’ during the term which is usually more like 17-18%. Historically, the collective would have taken first place in this scenario due to the higher Dividend Allowance and Annual Exempt Amount but this will no longer be the case.

Other considerations

As mentioned above, tax is one consideration, there are many more. Some are detailed in the table below:

| Collective | Offshore bond | Onshore bond | |

| Benefits |

|

|

|

| Drawbacks |

|

|

|

* with the exception of some withholding taxes

Conclusion

The table above is not exhaustive but it does show that each product has its merits. As has always been the case, a number of products to best use the allowances available to your client is the best option.

Even with reduced allowances, lower CGT rates provide value in the collective option but this must be weighed up with any additional costs incurred because of the administration burdens such a product can bring. The offshore bond can provide the best gross returns and with good exit planning can provide the best client outcome. However, smaller investments for shorter terms may struggle to absorb the charges associated.

Onshore bonds can be a good middle ground particularly for basic rate tax payers as they offer the simplicity of the tax being paid at source with only a personal liability to higher or additional rate tax. These may be less appropriate for non-tax payers as the life fund tax can’t be reclaimed.