This article explains how your estate will be distributed under the laws of England and Wales. It also touches briefly on how this differs from the laws of Scotland and Northern Ireland.

Intestacy

If an individual dies without leaving a valid will, the Court must decide who should administer their estate regardless of whether these would have been the people the deceased would have wanted to handle their estate.

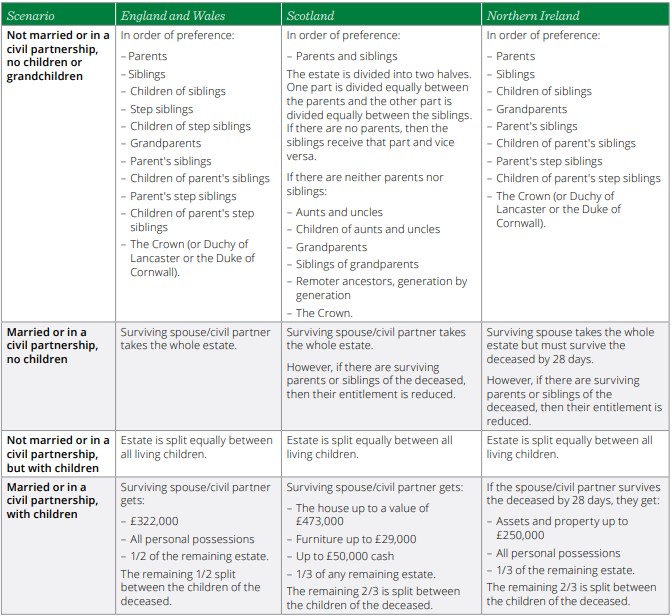

An estate must be distributed in accordance with the rules of intestacy. The rule differ across the UK, a summary is given in the table below.

The importance of writing a Will

Writing a Will means you can specify exactly how you would like your assets to be distributed after your death and allows you to name your Legal Personal Representatives (LPRs) as well as the guardians for your minor children. It can also be used to reduce your tax bill by utilising exemptions. For example, spousal and charitable bequests are exempt from IHT.

Even if you have a Will, it must be up to date and reflect your wishes, assets and current tax position. Marriage, civil partnership, divorce or dissolution can all have an impact on an existing Will.