The portfolios do not have a specific yield target, and this is by design. Yield is a function of price and as such will move around as the value of the holdings in the portfolios change. Instead, we focus on the income generated from each holding in the portfolios. This is a more reliable measure when planning the income the portfolios are likely to generate for your clients.

Investing with a focus on income

Providing a clear forecast

We spend a great deal of time assessing the underlying income streams within the portfolios.

A key focus is on ensuring the income streams are sufficiently diverse, with contributions from a range of sources across different asset classes. We also focus on the distribution profile of each holding, blending different payment frequencies and cycles to enable the portfolios to deliver a smoothed monthly income.

At the start of each fiscal year, we provide an estimate of the income in pence per share that the portfolios are likely to generate over the coming year. Providing this forecast offers you a better indication of what your clients are likely to receive based on the number of shares they hold.

Estimated and actual income per share since launch

| Monthly Income Portfolio | Monthly Income and Growth Portfolio | |||||

| Estimated income per share | Actual income per share | Actual income (£100k) | Estimated income per share | Actual income per share | Actual income (£100k) | |

| 1 May 2024-30 April 2025 | 3.50p-3.85p | - | - | 3.40p-3.80p | - | - |

| 1 May 2023-30 April 2024 | 3.25p-3.65p | 3.79p | £3,785 | 3.25p-3.65p | 3.77p | £3,768 |

| 1 May 2022-30 April 2023 | 3.1p-3.5p | 3.75p | £3,745 | 3.0p-3.4p | 3.75p | £3,751 |

| 1 May 2021-30 April 2022 | 3.0p-3.4p | 3.52p | £3,521 | 2.9p-3.3p | 3.41p | £3,413 |

| 1 May 2020-30 April 2021 | 2.7p-2.9p | 3.15p | £3,147 | 2.6p-2.8p | 2.98p | £2,977 |

| 1 May 2019-30 April 2020 | 3.33p* | 3.35p | £3,352 | 3.33p* | 3.07p | £3,070 |

Source: Quilter Investors. Income (pence per share) and annual income based on an initial investment of £100,000 in the U1 GBP Inc share class over the fiscal years shown to the end of April. The fiscal year of the portfolios runs from 1 May to 30 April. *The initial estimated income per share when the portfolios were launched on 26 June 2019 has been prorated to account for the portfolios launching two months after the start of the fiscal year.

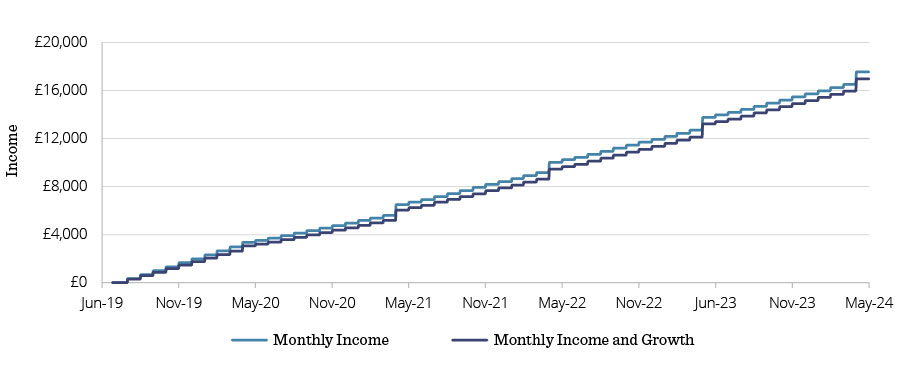

Delivering a smoothed monthly income

Our research tells us that clients seeking an income from their investments want a predictable income stream. The portfolios distribute a monthly income, providing your clients with a consistent income.

In addition, the income payments are smoothed throughout the year, reducing the difference in the payments paid to your clients.

Cumulative income distributions since launch (based on initial investment of £100k)

Source: Quilter Investors as at 30 June 2024. Cumulative distribution based on an initial investment of £100,000 in the U1 GBP Inc share class over period 26 June 2019 to 31 May 2024. The Monthly Income Portfolios launched on 26 June 2019.

Performance since launch

The tables below show the returns generated by the portfolios compared to their performance comparators since their launch in June 2019.

| 2023-2024 | 2022-2023 | 2021-2022 | 2020-2021 | 2019-2020 | |

| Monthly Income Portfolio | 8.9 | 0.5 | -5.9 | 12.2 | -3.0 |

| IA Mixed 20-60% Shares | 9.5 | 1.2 | -7.1 | 11.8 | -0.7 |

| 2023-2024 | 2022-2023 | 2021-2022 | 2020-2021 | 2019-2020 | |

| Monthly Income and Growth Portfolio | 10.6 | 2.8 | -4.9 | 15.9 | -2.4 |

| IA Mixed 40-85% Shares | 11.8 | 3.3 | -7.2 | 17.4 | 0.1 |

Source: Quilter Investors as at 30 June 2024. Total return, percentage growth, net of fees, rounded to one decimal place of the U1 (GBP) Accumulation Shares over time periods shown to end of June.

Next steps

View the brochure

Discover how we have designed the Monthly Income Portfolios in collaboration with financial advisers like you to deliver an income solution you can trust.

Find out more

Get in touch with your Quilter investment director to find out more about how the Monthly Income Portfolios can meet the needs of you and your clients.

Discover the monthly income portfolios

The Monthly Income Portfolios offer the choice of two different portfolios both designed to deliver a regular income alongside capital growth within a risk-targeted framework.