Creating a blended investment portfolio can be likened to a chef creating their signature dish. Both require a deep understanding of the ingredients and techniques needed to deliver the right end result.

Finding the right mix

A blended investment portfolio isn’t just about throwing some active and passive funds together and hoping for the best. Like a chef, a portfolio manager must achieve the right mix to deliver a good outcome. This involves selecting the right fund managers, mixing different investment styles, and making the tactical adjustments to create an expertly-crafted portfolio.

In this post-Consumer Duty world, blended portfolios have surged in popularity. These solutions can hit the ‘sweet spot’ - not only in terms of their pricing point, but also by combining the best of active and passive.

Boiling down the benefits

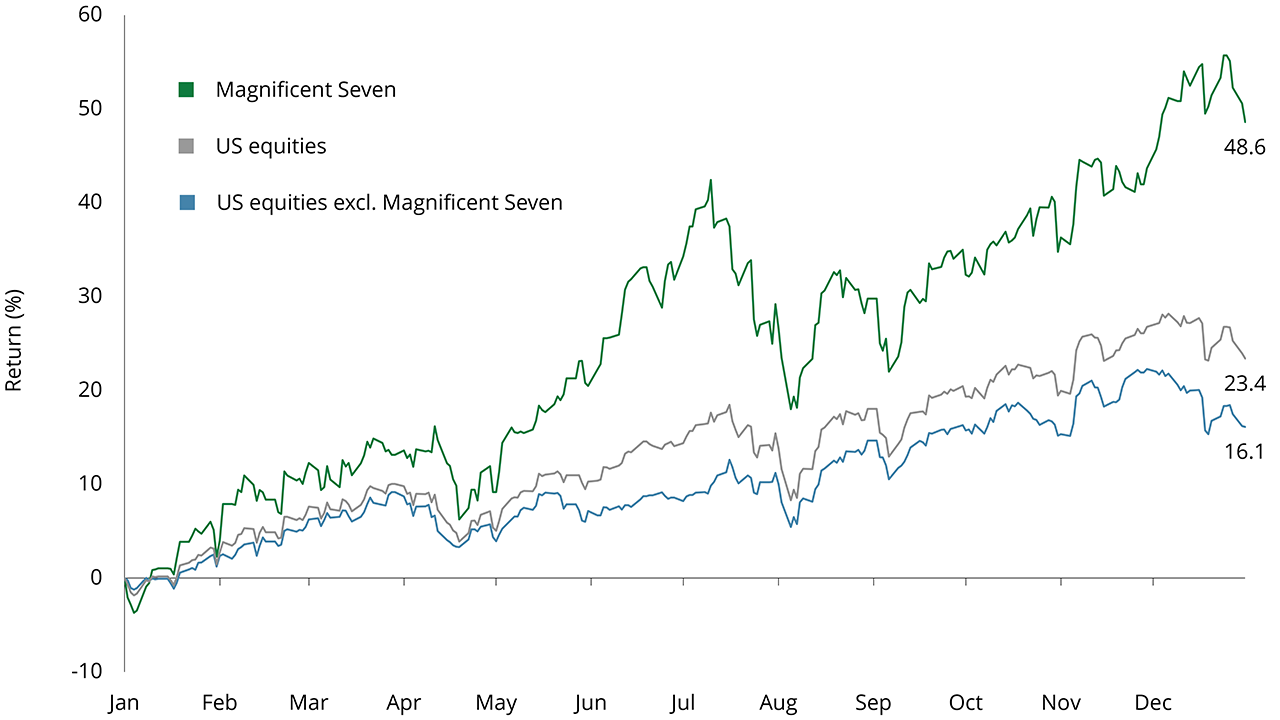

Take the current market dominance of the Magnificent Seven as a topical example. The surge in performance from this group of US mega-cap tech stocks has been a prevalent investment theme over the last two years.

Chart 1: Contribution of Magnificent Seven to market returns in 2024

Source: Quilter Investors and LSEG Datastream as at 31 December 2024. Total return, percentage growth, US dollars, rounded to one decimal place over period 31 December 2023 to 31 December 2024 of Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), the MSCI USA Index excluding magnificent seven, and the MSCI USA Index.

Passive strategies have benefited from the fact that these companies have become larger and larger in traditional market-cap weighted indices. Active strategies, seeking exposure to US large-cap equities, have found it difficult to own enough of these stocks, resulting in a significant difference in relative performance.

So, the case for passive in the example of the Magnificent Seven is clear: it provides a clear and cost-effective way to access and track certain investment markets. However, the benefit of a blended portfolio is that it can use the appropriate passive strategies whilst also using the flexibility and subtlety of active management techniques to better manage risks and make the most of other opportunities as they arise.

Balancing the flavours

Staying with the theme of the Magnificent Seven, we now have a heavily concentrated US equity market with incredibly high valuations. To put this into context, the US market makes up 67% of the MSCI All Country World Index, with the Magnificent Seven holding a higher weighting than the next seven countries combined*.

This means that certain passive strategies are heavily weighted towards a small subset of mega-cap tech companies. With the global geopolitical temperature rising against an uncertain investment backdrop, this could be a concern. The advantage for active strategies in this environment is having the ability to navigate away from this turbulence if required, whilst at the same time identifying other opportunities outside of this expensive group of stocks.

Finding the perfect recipe

To construct a blended portfolio, a portfolio manager needs to consider how much of each ingredient to use, just like a chef when writing their recipe. A portfolio manager should start with a solid base through a long-term strategic asset allocation to maximise risk-adjusted returns over time.

Like fine cuisine, blended portfolios can also benefit from the expertise of the professional crafting them. In a blended portfolio this can take the form of a tactical overlay to maximise short-term opportunities and implement investment conviction over three-to-six-month periods. The flexibility to be able to adjust the flavour of the portfolio by adding a dash of a particular asset, or less of a specific asset, is key.

Selecting the best ingredients

Once the recipe is written; the best dishes need the best ingredients. Selecting the right managers within a blended portfolio is no different. No one manager can be an expert at everything all the time so it’s about finding the best managers in each area through an in-depth manager selection and due diligence process.

Mixing ingredients from across a wide range of asset classes, market sectors, and geographies can then help capture the upside whilst also helping to dilute any potential downside. Having the ability to apply active management techniques can also introduce further flexibility and opportunity. For example, the portfolio isn’t just concentrated in areas where passive portfolios are obliged to invest.

The result

Whether you’re a blended portfolio manager or a master chef, generating the right outcome is a skilled art. By carefully blending the different investment techniques and approaches, blended portfolios can provide your clients with the right mix of resilience and opportunity in a cost-efficient way.

*Source: MSCI and Morningstar as at 31 December 2024.