The re-election of President Donald Trump and the UK government’s financial plan could put upward pressure on inflation and extend the era of higher-for-longer interest rates. For some, this might seem like good news, offering a chance to manage wealth without taking on investment risk. However, over the long term, traditional savings methods like cash do not fare as well as investing.

The rise of inflation (again)

We have witnessed the extraordinary re-election of President Trump to the White House, with the Republican Party achieving a clean sweep by retaining the US Senate and recapturing the House of Representatives. This strong mandate from the US electorate potentially paves the way for President Trump to pursue the bold promises he made during his campaign, which could trigger future price rises.

During his election campaign, President Trump promised to extend personal tax cuts for US citizens and further reduce taxes for US companies. Additionally, he has issued stark warnings to the rest of the world about the possibility of raising existing tariffs or introducing new ones, which would significantly increase costs for exporters to US consumers. These policies would likely lead to much higher inflation than the US Federal Reserve’s 2% target, and more importantly, could have a significant impact on future US interest rates and ultimately US corporate earnings.

Meanwhile, the new UK government presented their first budget in the autumn, surprising many with an increase in National Insurance contributions for the private sector. This change could have significant consequences. Businesses will face tough choices about whether to absorb this cost and dent their profits or reduce their workforce over time, increasing unemployment. Alternatively, they could dilute future workforce wage rises, or pass this extra cost on to their customers through higher prices, again putting upward pressure on inflation.

So, why are both the US election and the Labour Budget important for savers and investors?

Mind the savings gap

Until the last couple of years, inflation had been much lower by historical standards partly due to globalisation, which kept price rises suppressed and resulted in only gradual erosion of savings over time.

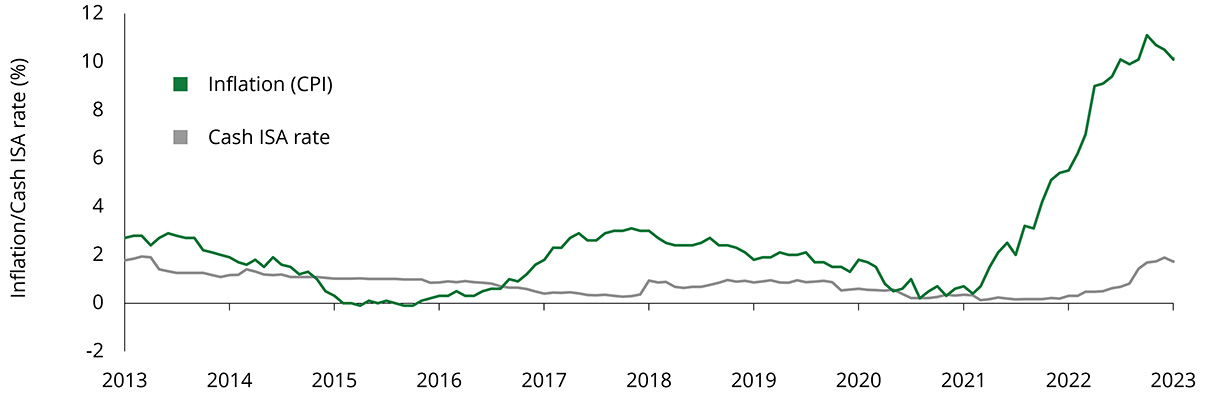

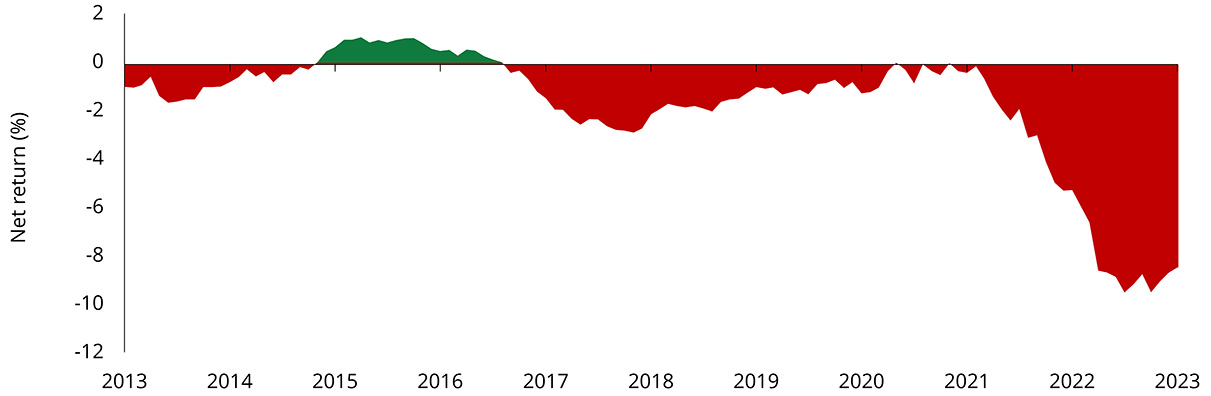

The charts below illustrate how the erosion gap widened significantly, even as savings rates began to increase. The data compares the Consumer Price Index (CPI) with the average cash ISA rate. It shows that although savers benefited from a sharp rise in the interest on their savings, this gain was more than offset by rising prices during the same period, leading to a much larger erosion gap than many probably realised.

Chart 1: Savings vs inflation

Chart 2: Net return from savings after inflation

Source: Quilter, ONS and Bank of England as at 27 November 2024. Consumer Price Index annual rate (ONS) and monthly interest rate of UK monetary financial institutions sterling cash ISA deposits (Bank of England) over period 1 January 2013 to 1 January 2023.

Why invest when interest rates are high?

There are numerous reasons why your clients choose to invest, with the primary objective often being to achieve growth that outpaces inflation. This goal can typically be met by adopting a long-term investment horizon and diversifying investments across bonds, equities, property, and alternative asset classes.

Diversifying across asset classes with low return correlations helps portfolios be more resilient to market shocks and downturns. Diversification also smooths out returns over a long-term investment horizon, helping your clients reach their financial goals.

It’s important to remind your clients that all investments carry inherent risks and can experience volatility, with values fluctuating both up and down, and no guarantees of investment return. This emphasises the importance of a long-term perspective. The ability to withstand market fluctuations and not sell investments prematurely can significantly enhance the likelihood of achieving real returns.

The benefits of long-term investing

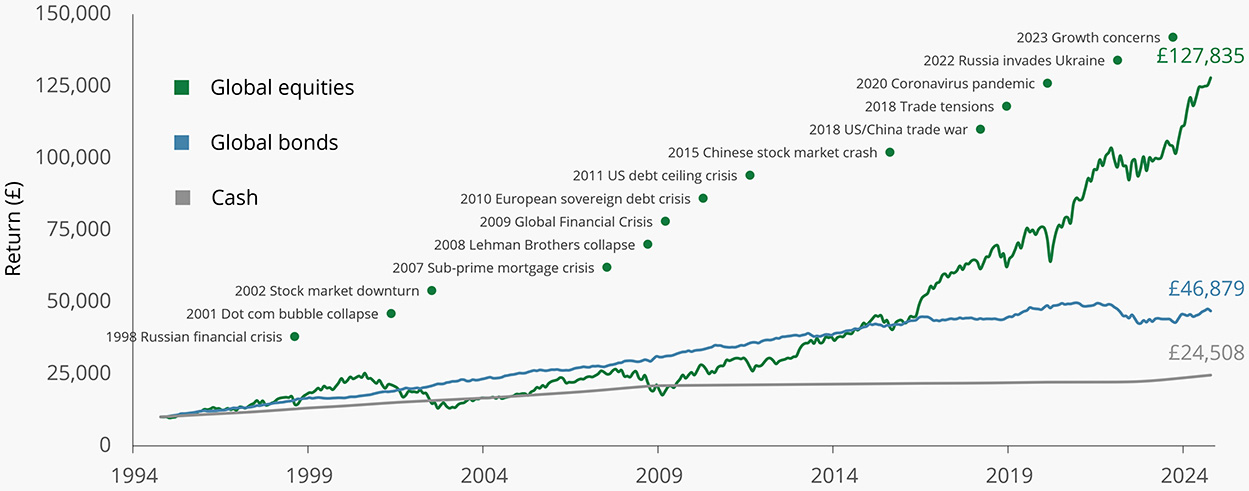

The chart below shows that over the long term, there is an upward trend of returns from equities and bonds, despite the short-term volatility caused by major events. In fact, a £10,000 investment into global equities in 1994 could have grown to be worth £127,835 today. This is nearly three times more than bonds (£46,879) and over five times more than cash (£24,508).

Source: Quilter Investors and FactSet as at 31 October 2024. Total return, percentage growth over period 31 October 1994 to 31 October 2024. Based on an initial investment of £10,000. Global equities is represented by the MSCI All Country World Index, global bonds is represented by the Bloomberg Global Aggregate (Hedged) Index, and cash is represented by the UK Base Rate. The information provided is for illustrative purposes only and doesn’t represent the past performance of any particular investment. It is not possible to invest directly into an index.

Conclusion

Despite the normalisation of interest rates to their historical averages over the past couple of years, both the re-election of President Trump and Labour’s financial plan in the UK pose a real risk of significantly higher inflation. Political decisions can greatly impact prices, asset values, and interest rates.

For those willing to invest over the long term, a multi-asset approach can be particularly beneficial. By spreading investments across a diversified range of asset classes, portfolios can become more resilient to market shocks and downturns. This can offer your clients a better outcome than if they relied solely on savings, even when interest rates are higher.