We’re now navigating the potentially volatility-inducing policies of a second Trump presidency. As a result, there’s likely to be even greater scrutiny on whether an investment solution can deliver suitable outcomes in line with an investor’s appetite for risk.

Meanwhile, third-party risk ratings remain as popular as ever. But what do the numbers in a risk rating mean? Can they evidence suitability? And how does a risk rating differ from a risk target?

Running the risk

In 2024, research by NextWealth found that 57% of financial advisers relied heavily on third-party risk ratings when recommending investment solutions for their clients. The popularity of these ratings has surged at the same time as the number of people using multi-asset investment solutions has increased.

Using a risk-rated investment solution is seen as a great way to demonstrate investment suitability aligned with an investor’s risk tolerance. In parallel, advisers can now embed risk ratings within their advice process more easily than ever thanks to the technological advancement of risk-profiling tools and investment research tools. But what is a risk rating and how is it calculated?

A calculated risk

A risk rating is a ‘moment in time’ quantitative assessment based on the expected volatility of an investment solution. A risk rating:

- looks at the expected volatility of the asset classes held within the solution

- weighs the expected volatility against the proportion of the asset classes held

- considers any assumed investment horizon.

Any investment solution can pay a third party for a risk rating. The quantitative assessment can support an advice process by making it easier to align a solution with an investor’s overall appetite for risk.

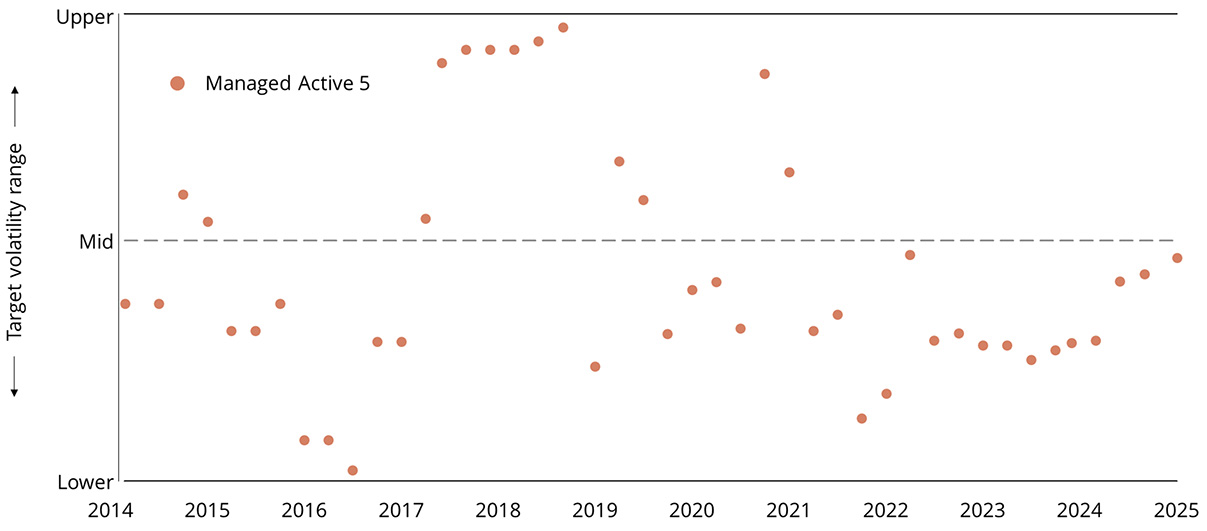

So, if a risk rating is just a snapshot of the fund or portfolio at the time it’s assessed, what does this mean for its risk profile in future? Taking an example investment solution with a risk rating of ‘5’, how confident can an adviser be that it will stay a ‘5’? And how would it react in times of market stress and heightened volatility? This is where a risk-targeted approach differs and can help support advice processes in a more robust fashion.